By Daryl Peeples

If you’re considering investing in commercial real estate, you’ve probably heard the term “cap rate” thrown around. Cap rates, short for capitalization rates, are a key metric used in commercial real estate to determine the value of a property and its potential return on investment. It’s essential to understand what cap rates are, how they are calculated, and how they affect the value of a property before you buy.

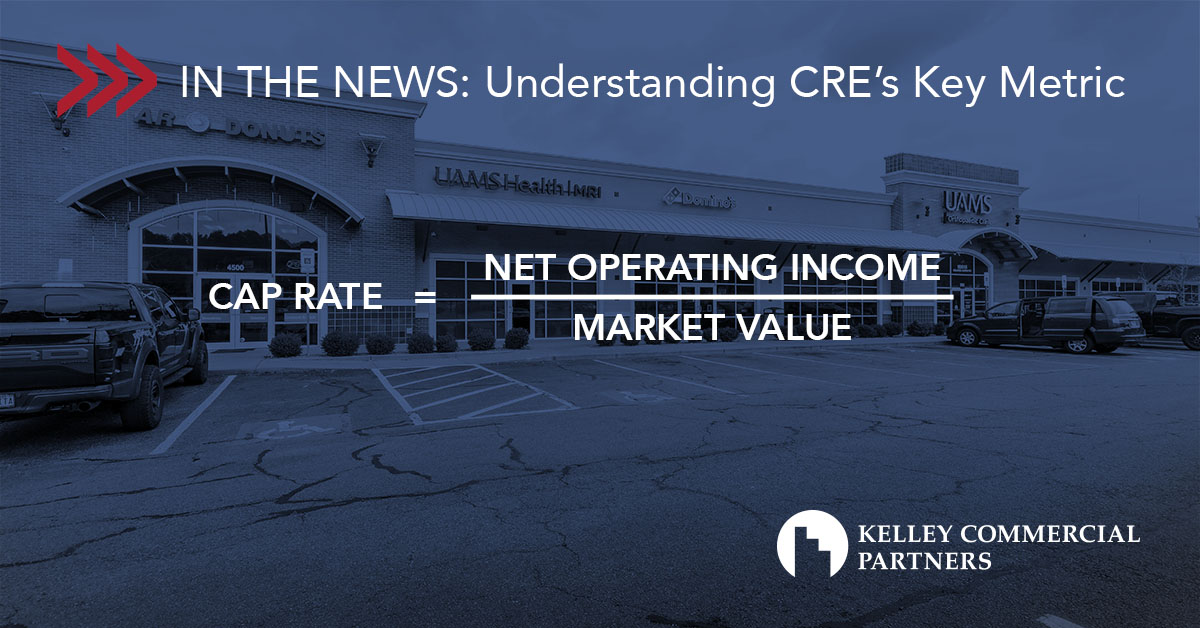

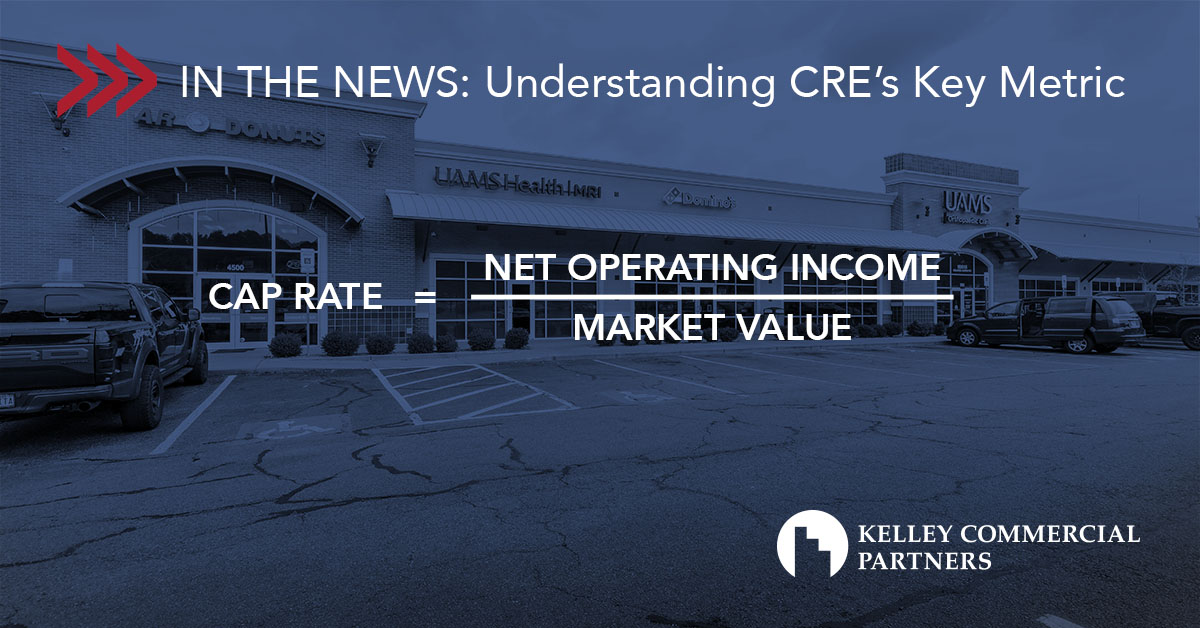

WHAT ARE CAP RATES?

Cap rates are used to determine the value of a property by calculating the net operating income (NOI) divided by the property’s market value. The NOI is the income generated by the property after all operating expenses have been deducted but before debt service and taxes. Cap rates are expressed as a percentage, with a higher percentage indicating a higher rate of return.

HOW ARE CAP RATES CALCULATED?

Cap rates are calculated by dividing the NOI by the market value of the property. For example, if a property generates $100,000 in NOI and is valued at $1 million, the cap rate would be 10% ($100,000 divided by $1 million). Cap rates can also be used to estimate the value of a property by multiplying the NOI by the cap rate. Using the same example above, if an investor is looking for a 12% return on investment, they would be willing to pay $833,333 ($100,000 divided by 12%) for the property.

HOW DO CAP RATES AFFECT THE VALUE OF A PROPERTY?

Cap rates play a crucial role in determining the value of a property. A higher cap rate means that investors are willing to pay less for the property, which can be an indication of higher risk, lower cash flow, or both. Conversely, a lower cap rate means that investors are willing to pay more for the property, which can be an indication of lower risk, higher cash flow, or both. Cap rates can also be used to compare the value of similar properties in the same market. For example, if two properties generate the same NOI but have different market values, the property with the lower market value and higher cap rate may be a better investment opportunity.

WHAT FACTORS AFFECT CAP RATES?

Several factors can affect cap rates, including the property’s location, condition, tenant mix, lease terms, and market conditions. Properties located in high-demand areas with strong economic growth and low vacancy rates typically have lower cap rates. Properties with long-term leases to creditworthy tenants and low operating expenses may also have lower cap rates. Conversely, properties located in areas with weaker economic growth, higher vacancy rates, and higher operating expenses may have higher cap rates.

HOW TO USE CAP RATES IN COMMERCIAL REAL ESTATE INVESTING

Cap rates can be a useful tool for investors looking to get involved in commercial real estate. By understanding cap rates and the factors that affect them, investors can make informed decisions about which properties to invest in and at what price. Here are some actionable tips for using cap rates in commercial real estate investing:

- Research the market: Before investing in a property, research the local market to understand the demand for commercial real estate in the area, vacancy rates, and economic growth.

- Evaluate the property: Evaluate the property’s condition, tenant mix, lease terms, and operating expenses to determine its NOI and market value.

- Compare cap rates: Compare the property’s cap rate to similar properties in the same market to determine if it is a good investment opportunity.

- Consider the risks: Consider the risks associated with the property, such as changes in market conditions, tenant turnover, and maintenance costs.

Our team of trusted commercial real estate professionals has the knowledge and experience in the local market to guide you through all the above and provide valuable insights into the investment potential of a property. For more information, please contact us.

Daryl Peeples

President | Principal Broker | Partner

Daryl joined the firm in 1985 and currently serves as president and principal broker, and partner. As principal broker, he ensures that all business conducted by the firm and its real estate activities adhere to the rules and regulations set by the Arkansas Real Estate Commission. Daryl provides strategic direction and leadership to advance the company’s mission and increase revenue, profitability, and growth as an organization.

Kelley Commercial Partners has an award-winning team of real estate professionals with the experience and knowledge to ensure you maximize your potential and reach your financial goals. Let us help you create a clear plan and provide the guidance you need to confidently move forward. Contact us today or click the links below to explore investment opportunities in Central Arkansas.